Keeping up with consumers is tough—just when you think you’ve got them figured out, they change course. But the brands that get ahead are the ones that see these shifts coming. In 2025, certain trends will take center stage, reshaping consumer expectations and market landscapes.

This whitepaper explores both micro trends, which signal emerging changes, and macro trends that drive long-term shifts in consumer behavior. With data-driven insights, businesses can anticipate these trends, refine their strategies, and unlock new growth opportunities. Whether it’s spotting the first signs of innovation or adjusting to broader shifts, understanding these trends will help your business stay competitive and ahead of the curve.

Ready to dive in?

Let’s explore the trends.

TREND 1: AI-ssisted shopping

AI shopping is rising, but human touch is still valued.

Why this trend matters

In 2025, AI isn't just a buzzword, it's the driving force behind smarter shopping decisions. Consumers, particularly in Western markets, are embracing AI tools to navigate the intricate world of retail. Whether it's finding the best deals or getting personalized product recommendations, AI is becoming the go-to assistant for making informed choices. This trend is especially critical as consumers face tighter budgets and look for ways to maximize value.

However, while AI is gaining ground, it's not without its challenges. Many shoppers still crave human interaction during their shopping journey. The message for brands and companies is clear: integrating AI into their strategy will be essential, as consumers are ready and waiting for the AI shopping experience.

The data behind it

Widespread AI adoption

Most consumers in Western markets are already comfortable with AI-driven shopping experiences, though enthusiasm in Japan lags slightly behind.

Unlocking AI-ssisted shopper priorities

Price remains the leading concern for consumers, so it is no surprise that price comparison tools top the list of desired AI shopping features.

Product discovery and recommendations will also be essential for driving consumers’ purchasing decisions.

Human touch still matters

However, even as AI rises, human interaction remains vital. Consumers want to know that human support will be available to them, particularly in the countries that are most receptive to AI innovations.

Strategies for success

Integrate AI

Prepare for a future where AI streamlines the entire consumer journey, from product discovery to purchase. Invest in AI tools that excel in price comparison, product recommendations, and personalized shopping experiences.

Data-driven strategies

Use consumer insights alongside AI to tailor your marketing and product offerings to meet the specific needs of your audience.

Hybrid approach

Blend AI-driven solutions with accessible human support to ensure you cater to all consumer preferences.

Build trust in AI

Launch campaigns that educate and reassure consumers, particularly in sectors where AI adoption is still met with skepticism.

TREND 2: The loyalty seeker

Use loyalty programs to grow, not just retain.

Why this trend matters

Loyalty programs should no longer be seen as a way to reward existing customers, but rather as a powerful tool for growing a customer base. As we approach 2025, the cost-of-living crisis has made consumers more

selective about where they spend their money.

While affordability is crucial, consumers are increasingly seeking brands that offer additional value beyond price—such as cashback, discounts, and exclusive offers—making loyalty programs a key factor in their purchasing decisions. This trend is especially strong in the UK and U.S., with varying degrees of enthusiasm in Japan

and Germany.

The data behind it

Loyalty as a driver, not just an outcome

Consumers around the globe cite loyalty programs as a significant factor in where they choose to shop. German consumers, however, are not as easily influenced as their UK and U.S. counterparts.

Double down on discounts

Discount coupons are the most enticing loyalty and rewards program on offer, being the most popular in Germany and Japan, and wanted by half of consumers in the U.S. and UK. However, cashback is king for

U.S. and UK consumers.

Strategies for success

Promote affordability and support

Position loyalty programs as a way to help consumers navigate financial challenges, emphasizing the added value they provide beyond just discounts.

Tailor to regional preferences

Focus on discount coupons in Germany and Japan while maintaining a strong cashback presence in the U.S. and UK.

Broaden your loyalty offerings

Create multi-faceted loyalty programs that combine cashback, discount coupons, and exclusive offers to appeal

to a wider audience.

TREND 3: Influence immune?

Consumers tune out influencers due to trust gap.

Why this trend matters

The meteoric rise of online influencers has reshaped consumer habits, but as we head into 2025, has their impact been overstated? While the number of consumers inspired to purchase products recommended by influencers is growing, the rate of growth is slow and has even plateaued in some regions. So, have we reached the peak of influencer impact or is there something else driving consumers to overlook influencer-driven marketing?

In a world where authenticity is currency, our data shows that trust is a key factor in how consumers view influencers. Despite their massive followings, influencers are seen as one of the least trustworthy professions, alongside celebrities and politicians. This growing mistrust may also impact direct-to-consumer sales channels, with consumer’s reluctance toward influencer-led campaigns. And, while influencers still hold sway with Gen Z,

brands may need to rethink their strategies to build long-term trust and engagement.

The data behind it

Insta-nt trust issues

When asked which professions consumers trust most, influencers are at the bottom, along with celebrities and politicians. Consumers are much more likely to trust spokespeople who are experts in their fields such as farmers, scientists, teachers, or healthcare professionals. The trust gap is already evident in sectors closely linked to online

influencer culture, such as beauty. This shift underscores the values of consumers, prioritizing trust and credibility over fame.

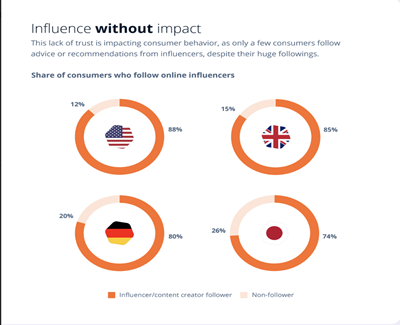

Influence without impact

This lack of trust is impacting consumer behavior, as only a few consumers follow

advice or recommendations from influencers, despite their huge followings.

Share of consumers who follow online influencers

Direct to no-one

Consumers have shown little interest in fashion brands prioritizing direct-to-consumer sales through influencers or celebrities, signaling a lack of enthusiasm for these types of purchasing channels. This tepid response suggests that shoppers may be seeking different, perhaps more innovative or personalized, ways to engage with fashion brands, beyond a solely influencer-driven approach.

Saturation point or influencer-infancy?

Influencer marketing is rising slowly, but in some cases seeing its influence plateau. However, in the West, Gen Z is the most receptive demographic to influencer marketing. With Gen Z’s spending power rising, it may be too soon to dismiss influencers entirely.

Strategies for success

Engage micro-influencers

Focus on using data to identify micro-influencers who have genuine engagement rather than just large followings.

Trust-oriented campaigns

Craft campaigns centered around long-term collaborations that emphasize product quality, honest reviews, and authenticity.

Diversify channels

Expand beyond influencer marketing and incorporate more direct consumer feedback and peer reviews into product strategies, offering a balanced approach to trust building.

Target Gen Z smartly

As Gen Z shows the greatest trust, brands must nurture this demographic through authentic, trust-building strategies rather than short-term sales pushes.

TREND 4: Omni-wellness

Every purchase is a wellness choice now.

Why this trend matters

Wellness is no longer confined to one category—it permeates every aspect of consumers' lives. From the foods they eat to the beauty products they apply; consumers are prioritizing health and well-being across all industries. In 2025, wellness is a core consideration in purchasing decisions, with consumers seeking out products that not only meet their needs but align with their health goals.

Whether its functional foods focused on gut health or beauty products made with natural ingredients, the demand for transparency and healthier options is growing. Consumers want to know how products impact their overall wellness, driving a broader shift toward holistic well-being. Brands that prioritize offerings and transparent

communication will capture consumer attention, helping consumers make informed, health-driven choices in all areas of their lives.

The data behind it

Investing in wellness

A considerable portion of consumers are willing to invest more in products that promote health, particularly within the food, fashion, beauty, and lifestyle sectors. Nutrition and exercise in particular stand out.

Wellness goes mobile

And by looking at user trends within the digital health market, we can see that consumer appetite for engagement with their health and wellness, via apps, will continue to grow year on year during this decade.

Functional foods

Many consumers are becoming more intentional about their food choices, actively seeking out functional foods that offer targeted health benefits. Consumers are carefully selecting items based on their nutritional value, ingredients, and potential to support long-term health goals.

Nutritional revolution

A third of U.S. consumers now place value on nutritional content when making purchase decisions. Particularly in the west, consumption of fruits and vegetables and a corresponding decrease in sugar intake are the most common steps for consumers to eat more healthily.

Ingredient-centric beauty

Consumers are avoiding beauty products with harsh chemicals, preferring organic options and making purchases

based on specific ingredients.

Knowledge-hungry consumers

Consumers are not just buying—they are learning. There is a strong desire for more education on the products they consume, pushing industries to offer greater transparency and information.

This is an important consideration for brands situated in Western markets, whereas in Japan, the search for knowledge in these areas is less important to consumers.

One notable micro trend is the fascination with gut health, which one in five consumers have learned about in the past year.

Strategies for success

Emphasize transparency

Clearly communicate the health benefits of your products, focusing on nutritional content, ingredients, and overall wellness impact.

Innovate with functionality

Develop products that offer functional benefits, such as foods that support gut health or beauty products that use

natural, organic ingredients.

Leverage personalization

Utilize consumer data to offer personalized product recommendations that align with individual health goals. This can include tailored meal plans, customized beauty regimens, or personalized wellness products

that meet specific dietary or skincare needs.

Educate your audience

Invest in educational campaigns that inform consumers about the health benefits of your products and the ingredients they contain.

Conclusion

As consumer behavior continues to evolve, staying ahead of the trends isn’t just an advantage—it’s essential. The insights shared in this whitepaper give you the foundation to make data-driven decisions, adapt your strategies, and lead your market in 2025. With the right tools and foresight, your brand can not only meet consumer expectations but exceed them, driving growth and lasting success.